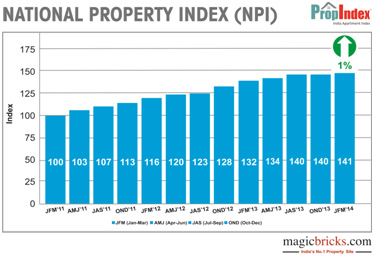

National Property Index (NPI) grew by 1 per cent as per Magicbricks PropIndex (Jan-Mar 2014). The index in its third year showed that home-buyers preferred to be in the wait-and-watch mode due to the general elections.

29 April 2014: “Capital values fell in all cities, except Pune. Over 30 per cent of the tracked localities registered a fall of 1-9 per cent. However, rental values rose by 2-16 per cent across India with over 50 per cent localities across cities registering a rise.” the latest Magicbricks PropIndex reports.

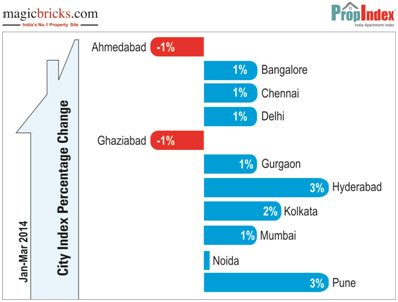

City Index values, computed as a ratio of number of listings to prices, rose by 1-3 per cent, indicating that buyers who purchased for regular rental returns were winners. Ahmedabad and Ghaziabad registered a negligible drop of 1 per cent in the index values.

Political Uncertainty

“The year 2014 started with anticipation among real estate stakeholders concerning the 16th general elections in the country. These Lok Sabha elections kept the Indian Real Estate Market in the wait-and-watch mode. This was reflected in the National Property Index, registering a 1 per cent change in the Jan-Mar 2014 quarter.” explains Sudhir Pai, Business Head, Magicbricks.com

Demand Analysis

Mid-budget range of Rs 30-50 lakh remained the preferred category, especially in Bangalore and Pune.

Premium luxury properties remained oversupplied across cities despite a robust demand of over 20 per cent. Mumbai topped the chart with maximum demand for properties worth Rs 1 crore and Above, followed by Delhi and Gurgaon.

High-end properties worth Rs 2 crore and above remained more in demand in Delhi, Gurgaon and Mumbai. In all other cities luxury demand remained in the

Rs1 crore and Above range.

Robust Smaller Markets

In the current PropIndex issue, Greater Noida has been incorporated as an independent city, recording growing demand for residential properties and offering several options in the affordable range.

“The formation of a new government is expected to infuse fresh life into the real estate market and improve home buyer sentiments. In the Jan-Mar 2014 quarter, property markets remained sluggish. However, robust demand from end-users arrested any significant change in property values.” adds Jayashree Kurup, Content & Research Head, Magicbricks.com

City Specific Headlines

Delhi Trends

• Rental values rose in nearly 75 per cent localities. Of these, 35 per cent registered an increase of over 5 per cent

• Large housing units of 4BHK & Above worth over Rs 2 crore were more in supply than in demand, increasing the demand-supply gap in the last six months

• A small rise of 3-4 per cent was noted in capital values during the Jan-Mar 2014 quarter. Localities such as Greater Kailash-I, Safdarjung Enclave, Shivalik, Malviya Nagar and Panchsheel Enclave in South Delhi registered the maximum increase of 3-4 per cent

Gurgaon Trends

• Over 82 per cent localities recorded a rise between 2-16 per cent in the average rental values

• Rumours of resolution of litigations on the Dwarka Expressway led to it rising from the fifth to the third position in the chart of the top ten preferred localities for sale

• Golf-Course Road was given the thumbs down by consumers for both sale and rent because of the ongoing metro work along the stretch. This downgraded the locality preference by 2 points

Noida Trends

• Sectors 100, 137 and 143 along the Noida-Greater Noida Expressway and Sectors 74 and 78 posted over 25 per cent increase in the capital values in the last two years

• Delay in possession reduced the preference for Sector 128 by one position

Ghaziabad Trends

• Upcoming new projects in Lal Kaun at low base price of Rs 2,600-3,300 per sq ft captured the buyer’s attention. This pushed up the locality in the top ten preference chart

Mumbai Trends

• Panvel and Ulwe offered maximum options in the Rs 20-40 lakh range, in the new developing projects in Navi Mumbai in the Jan-Mar 2014 quarter

• The average rental price recorded a rise of 3-12 per cent in over 90 per cent of the tracked localities

• Robust rental market led to improvement in the gross rental return on investment to 1.87-3.47 per cent

• Demand for residential housing increased by 2 per cent for properties worth Rs 1-2 crore, however, supply remained stable

Pune Trends

• Pune noted a rise in average capital values in over 80 per cent of the tracked localities

• The city offered maximum number of newly built ready-to-move-in multi-storey apartments in the range of Rs 50-60 lakh in the 2BHK category. Maximum availability was in Wakad and Pimple Saudagar

Ahmedabad Trends

• Demand for premium properties worth Rs 1 crore and Above increased by

4 per cent, while it dropped by 5 per cent in properties worth Rs 40-70 lakh

• SG Highway moved up three positions to settle at number three due to commercial set-ups and availability of both ready-to- move-in and under-construction properties at affordable prices

Kolkata Trends

• Over 70 per cent localities recorded a rise of 2-10 per cent in the average capital values

Chennai Trends

• Vadapalani and Virugambakkam in the Central-west and Nungambakkam in the Central witnessed a sharp drop of 10 per cent

• Of the tracked localities, 50 per cent recorded a rise in rental values

• Demand and supply for luxury units dropped by 2 per cent for properties worth Rs 1 crore and Above

Hyderabad Trends

• The buyer demand shifted from 2BHK to 3BHK units. Maximum properties delivered were in the 3BHK segment, within the budget of over Rs 70-80 lakh

Bangalore

• Central Bangalore witnessed the maximum demand for high-end units worth Rs 1 crore and Above

• Bellandur, Whitefield and Marathahalli in East Bangalore clocked the highest increase of over 15 per cent in average capital values in the past one year

• Over 70 per cent of the tracked localities recorded a rise in rental values

Full report details can be accessed here – propindex.magicbricks.com