87% employees prefer a customised compensation structure; organisations need to take that into account while designing benefits

May 22, 2014: According to TimesJobs.com’s latest Compensation and Benefit survey, rising inflation and increasing cost of living has led employees to re-evaluate their priorities on how they are compensated for their work. Our survey indicates that most employees, across generations, prefer a higher ‘in-hand’ pay out compared to other components of the salary.

‘In-hand’ salary matters more to the junior level employees than the mid or senior level. Kishore Sambasivam, director-total rewards, SAP, attributes this trend to the fact that employees at junior levels are typically single and seek ownership. They do not want money locked up in a PF or superannuation benefit. Employees at this level want to plan their investment strategies which may have a higher risk and return profile.

Factor-in their goals

“Effective management starts by understanding who you are managing. This boils down to knowing the expectation the workers have from the organisation. As indicated by our survey, the future of compensation will be a customised compensation and benefit package to suit the needs of the employee.” explains Vivek Madhukar, COO, TimesJobs.com

According to the survey, almost 90 per cent employees prefer a customised compensation package. Their priority of what is more important to them depends on the stage of their career and their age.

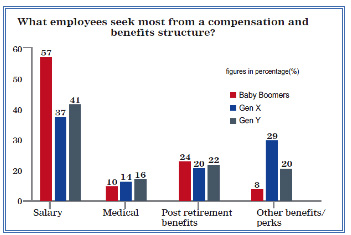

While salary remains core to all age groups, the Baby Boomer Generation prefer post retirement benefits (24%) such as PF and Gratutity, there is a marked distintion for other perks in the Generation X segment with 29% wanting club memberships, car, and company housing. The Youngest Gen Y Generation is eager to have it all with an equal balance of about 20% for each benefit – be it Medical, Post Retirement or other perks. But by and large salary remains the core consideration for all levels coming in lowest at a considerable 41% for Gen Y and a High of 57% for the boomer generation.

According to Sambasivam, employees prefer flexibility in their compensation structure. This is dependent on the changing demographic profile, priorities, preferences, risk orientation, individuality and ‘live-in-the-present’ mindset. Traditionally, companies focused on long-term orientation such as Provident Fund (PF), superannuation, company provided accommodation, Leave Travel Allowance (LTA), loans etc. Now, employees prefer more cash-in hand as it gives them the flexibility to spend as per their aspirations and lifestyle.

“Companies need to be cognizant of the same and modify their compensation structure and philosophies in line with the changing expectations of the workforce”, added Sambasivam.

Summing up, Raghavendra K, vice president and head human resource development, Infosys BPO, said that a healthy compensation and benefit structure should have a balance between financial and nonfinancial components and should be aligned with the strategic priorities of the organisation.

Visit www.content.timesjobs.com for more TimesJobs.com Insights